Real estate has always been one of the best investment options in the world and is known as an appreciating and stable asset. However, commercial properties, which usually give higher returns than residential properties, remain out of reach for many investors due to their high investment. Now, because of an innovative concept known as fractional ownership, it is possible for investors with a low investment budget to invest in commercial properties.

In this blog, we will explore fractional ownership in India, its advantages and disadvantages, and how it can transform the Indian real estate sector.

What is Fractional Ownership?

Fractional ownership is a simple idea that allows a group of people to buy a valuable property together. Unlike traditional investments like REITs or mutual funds, fractional ownership gives each person a direct share in the property. This means that everyone gets a part of the property’s rental income and any increase in its value, depending on how much they’ve invested.

This model is implemented through technology platforms, which connect investors, help them make transactions, and ensure that everyone knows what’s going on with the deal. These platforms make it easy for everyone to get involved in this exciting real estate investment opportunity.

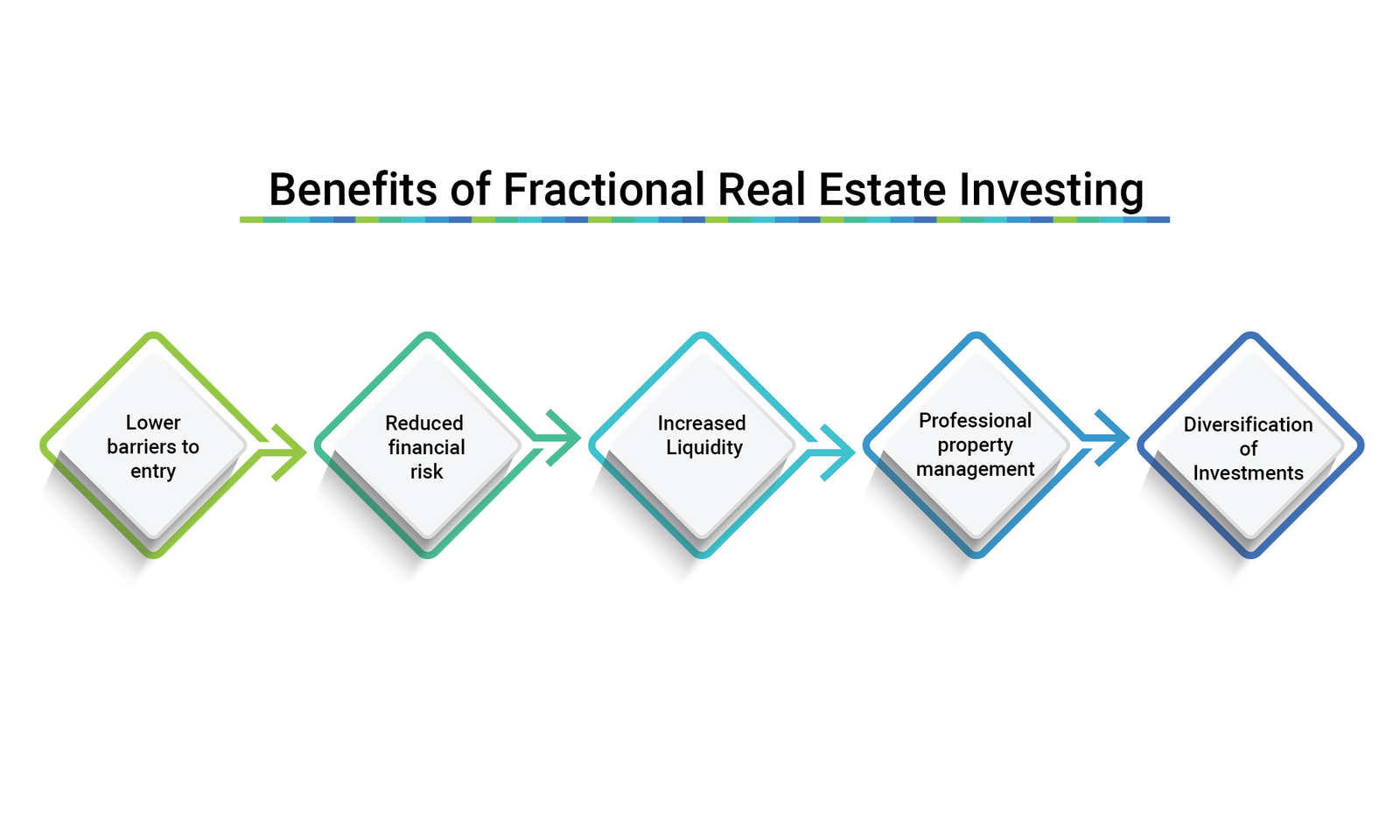

Advantages of Fractional Ownership

Easy Accessibility to High-Value Properties

Commercial property investment usually requires a large amount, sometimes in crores, making it inaccessible for most individual investors. Fractional ownership in real estate lowers this entry barrier by allowing investments starting from as low as ₹5–10 lakhs, depending on the platform and property.

Diversification Opportunities

Fractional ownership enables investors to diversify their real estate portfolios by investing in multiple properties of different types, such as retail shops or office space in various locations and budgets. Diversifying the portfolio reduces risk and enhances the potential return.

Regular Passive Income

Almost all properties acquired under fractional ownership generate rental income, distributed among investors in proportion to their investment and ownership. This steady stream of passive income can supplement other earnings or retirement plans.

Capital Appreciation

Typically, the well-selected properties are appreciated over time, and investors who have invested in fractional ownership benefit from this capital appreciation and rental income.

Professional Management

Most fractional ownership platforms are run through professional management and offer end-to-end property management services, including tenant acquisition, rent collection, property maintenance, and compliance. This makes it a hassle-free experience for investors.

Enhanced Liquidity

Traditional real estate investments can be hard to sell, but some fractional ownership platforms offer ‘secondary markets options ‘. This means that if you need to sell your share of the property, you can do it through the platform, just like you would sell a stock or a bond.

How Fractional Ownership Can Change the Indian Real Estate Sector

India’s real estate market is poised for exponential growth and is on the brink of a transformative period. This exceptional growth is due to rapid urbanization, growing demand for quality infrastructure, and increasing foreign investment. However, the real estate sector faces challenges such as high capital investment, low transparency, and limited participation from ordinary retail investors.

Fractional ownership has the potential to address these issues and revolutionize the real estate sector, offering a bright and hopeful future for the Indian real estate sector.

Democratizing Real Estate Investments

Fractional ownership is a game-changer for the real estate sector in India, especially for commercial real estate, by making it accessible to a broader investor segment. It enables lower and middle-income investors to participate in the investment opportunities usually reserved for high-net-worth individuals (HNIs) and big institutional players. This democratization could attract immense retail capital into the real estate sector, empowering a new wave of real estate investors.

Bring Transparency and Accountability

The rise of technology-driven fractional ownership platforms will bring transparency to real estate transactions. Investors can easily access financial projections, detailed property information, and legal documentation, bringing credibility and trust to the market. This deal transparency can give investors the confidence to participate in fractional ownership.

Bringing Growth in Tier 2 and Tier 3 Cities

Fractional ownership can bring investments into Tier 2 and 3 cities, which can emerge as new growth hubs, especially in commercial properties. This can create job opportunities, spur economic activity, and improve infrastructure in these regions.

Encouraging Institutional Participation

The fractional ownership platforms’ transparent and structured nature can attract institutional investors who are wary of the unorganized Indian real estate market. Increased institutional participation in the Indian real estate market can further stabilize and enhance its credibility.

Asset Capitalization for Developers

Many developers in India struggle with large unsold inventory and liquidity constraints. Fractional ownership platforms can help these developers monetize their assets more quickly and efficiently by selling fractions to multiple investors instead of waiting for a single buyer.

Fractional Ownership in India: Key Challenges and the Road Ahead

While the fractional ownership holds immense potential, its adoption in India depends on addressing specific challenges:

Regulatory Framework

For the smooth running of the fractional ownership concept in India, the government needs to establish clear guidelines to govern it, protect investor interests, and prevent any model misuse.

Awareness among Investors

Most Indian retail investors are unfamiliar with this concept and its benefits. Awareness campaigns must be conducted to educate investors about this concept and build trust in them.

Technology and Security

Fractional ownership platforms must invest in secure and robust technology to ensure efficient due diligence, property management, seamless transactions, and investor data security.